When do I get my Deed?

After the transfer of title is completed, the Notary will register the updated Trust Deed with the local government offices and pay all necessary taxes for both parties. Within 10-14 days, the Notary will provide the Purchaser and their representatives with a copy of the Trust Deed to assist with transferring utility contracts and finalizing club memberships. Approximately 3-4 months after closing, the Notary will issue the final closing package, which will include a certified original Trust Deed in favor of the Purchaser, a certified English translation, a summary of property and deed information, a final closing statement, and all receipts for closing expenses, fees, and taxes paid. The Notary will also provide a closing Escrow ledger to reconcile deposits. All documents will be provided in both paper and digital formats and will be sent to the Closing Officer or held for the Purchaser as requested. The Notary will also provide the Seller with a copy of all fees and taxes paid on their behalf, which can be used for credit in the US or Canada, or other treaty compliant countries, for taxes paid on foreign income earned.

The FINAL CLOSING PACKAGE provided to the Purchaser will include:

A certified copy of the registered Trust Deed

A certified translation of the registered Trust Deed

A Trust Deed Summary form, detailing important information such as the legal description, owner of record, registered value, and tax ID number

The final Settlement Statement and Escrow Disbursement Ledger, as well as any applicable refunds

Receipts for all closing expenses, such as acquisition tax, bank fees, and Notary’s fees

Copies of all prorated expenses paid, including property taxes and HOA fees

The Title Insurance Policy, if purchased

The FINAL CLOSING PACKAGE provided to the Seller will include:

A certified letter from the Notary regarding the payment of Capital Gain Tax (ISR) or any applicable exemptions

A copy of the receipt for payment of Capital Gain Tax (ISR)

A copy of the receipt for payment of any other related expenses

The final Settlement Statement

WHAT INFORMATION DO I NEED TO PROVIDE TO BUY OR SELL MY PROPERTY?

INFORMATION AND DOCUMENT REQUIREMENTS

Despite being held in trust by a Mexican authorized Trustee Bank, title can be held by Owner in nearly any manner accepted in the US; as an individual(s) in joint or separate tenancy, in an estate trust(s), in an LLC or incorporated entity, in a partnership agreement or in any combination thereof.

The requirements to complete the requisite file for the Notary, Trustee Bank, and the Foreign Affairs Ministry, however, are extensive. to companies’ confusion as compliance to it’s on foreign entities. Current Money Laundry Law requires even more.

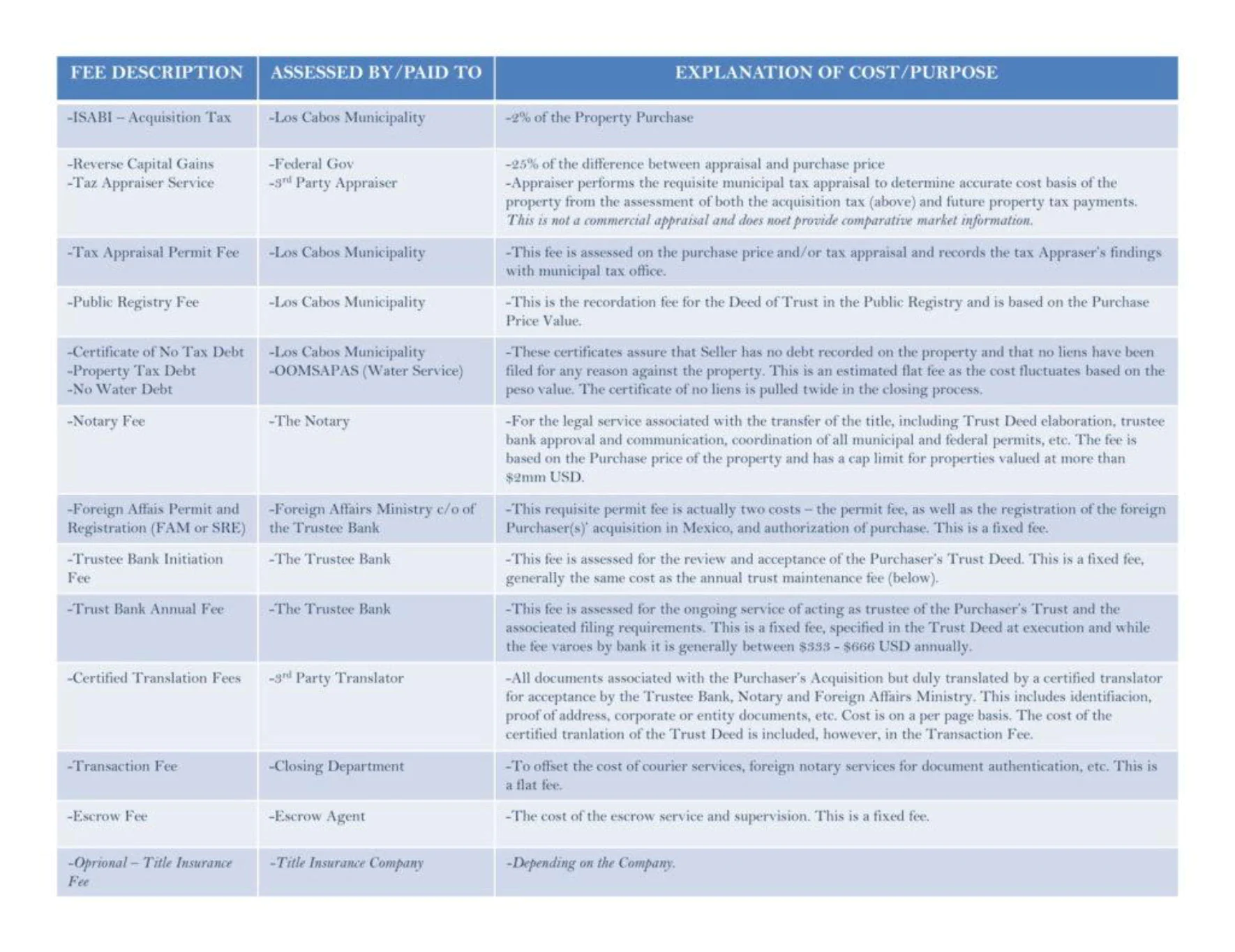

EXPLANATION OF CLOSING COSTS IN MEXICO:

Closing costs in Mexico are quite different than most of our US or Canadian Purchasers are accustomed to. Outlined below is a simple explanation of the fees associated with a cash transaction (no- financing associated with the Property).

Closing costs are always assessed to the Purchaser and unlike in the US or Canada, are not negotiated for payment by the Seller. All Closing fees paid in Mexico (with exception to title insurance and extraneous legal fees) are added to the Purchaser’s complete acquisition cost for cost basis. All taxes and fees are calculated over the peso value of the price of the property regardless of currency transacted at purchase. Any fees provided prior to closing, and until the date of payment, are subject entirely to the peso exchange rates on the date of payment and/or exchange of currencies.

What closing fees does the Seller Pay?

At settlement, Seller is responsible for:

Payment of all debt associated with the Property

Capital Gain Tax (ISR) and Filing Fees

Seller’s legal fees

Realtor’s sales commissions

Prorated fees assessed for property tax, homeowner’s associations and utilities if applicable (these items may be a credit to Seller-paid in full at closing).

How are Seller’s Capital Gain Calculated?

The Notary will calculate the Seller’s capital gain tax based on Seller’s purchase price, in Mexican Pesos, at acquisition. This information is indicated in the deed of title.

To the Seller’s original purchase price, the Notary adds to the value, the cost of any construction or remodel facturas, as well as the closing costs that the Seller paid at acquisition. After applying annual inflationary credit and construction depreciation factors, the resultant cost basis is determined.

The Notary then determines the capital gain tax (ISR) by subtracting the cost basis, as well as the sales commission from the sale price, to obtain the ‘gain’, which is taxed at 35%.